The Bank of Ghana (BoG) has introduced a major policy reform with the launch of a new Foreign Exchange (FX) Operations Framework, that will ensure transparency and predictable market operations.

The move is designed to strengthen market confidence, reinforce exchange rate stability, and enhance accountability in Ghana’s foreign exchange management.

Announced in a statement on Tuesday, November 11, and approved by the BoG Board, the new framework replaces the central bank’s previous discretionary interventions with a “discretion-under-constraint” model.

Under this approach, all FX operations will follow transparent, pre-announced rules rather than ad-hoc decisions, in line with the BoG’s core mandate of maintaining macroeconomic stability within its inflation-targeting regime and a flexible exchange rate system.

Core objectives driving FX interventions

The BoG outlined three key objectives that will guide all FX interventions under the new framework:

Remove ads

Reserve Accumulation: The Bank will systematically build robust foreign reserve buffers to protect the economy from external shocks and global market uncertainties.

Volatility Management: Interventions will focus on reducing short-term fluctuations in the cedi’s value, maintaining orderly market conditions without attempting to control long-term exchange rate trends.

Market-Neutral Intermediation: The BoG will act transparently as an intermediary, channelling official foreign exchange inflows—including revenues from the Gold Purchase Programme and export surrender requirements—without influencing the natural direction of the market.

A central feature of the new system is the introduction of competitive, variable-rate, fixed-amount FX auctions, aimed at ensuring fairness and efficiency in market operations. The BoG will pre-announce auction amounts and publish full results on the same day to promote transparency and market discipline.

In addition, the Bank will publish aggregated monthly data on FX operations within five business days after each month’s close. The data will be disaggregated to show which operational objective—Reserve Accumulation, Volatility Management, or Market-Neutral Intermediation—guided each action.

“This new FX Operations Framework reflects our commitment to transparency, market confidence, and macroeconomic stability,” the Bank of Ghana stated. “By clarifying our objectives and processes, we aim to strengthen resilience while preserving the flexibility of Ghana’s exchange rate regime.”

The launch of the framework comes as the Ghana cedi has recently been ranked among the best-performing currencies in sub-Saharan Africa, a development the BoG attributes to prudent monetary policy, improved FX inflows, and disciplined market interventions.

Bank of Ghana launches new rule-based FX framework for transparency and Cedi stability

Business

|

|

52 views

3 months ago

Comments

Leave a Comment

No comments yet. Be the first to comment!

3News

More in Business

Cedi buys at 11.09 to a dollar, sells at 11.10 on Monday Dec. 29 per BoG rate

Dec 29, 2025

Read more

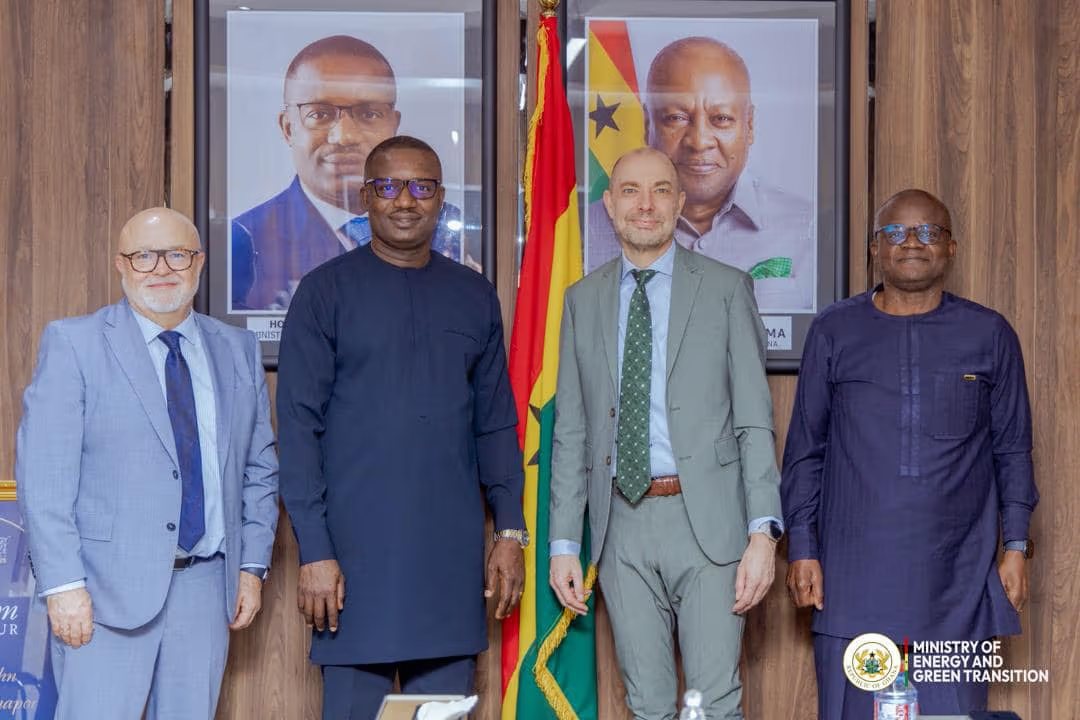

Energy Minister emphasizes commitment of govt to increase share of renewable energy in Ghana’s energy mix

Dec 18, 2025

Read more

Total MoMo transaction values up by 56.8% to GH¢ 3.01 trillion in 2024 from GH¢1.92 trillion in 2023 – BoG Report

Dec 12, 2025

Read more